capital gains tax australia

If you hold that asset for more than a year it will be taxed at your long-term capital gains rate of 15. Capital gains tax CGT is the levy you pay on the capital gain made from the sale of that asset.

Pdf Taxing Capital Gains A Comparative Analysis And Lessons For New Zealand

Capital gains tax CGT is the tax you pay on profits from selling assets such as property.

.jpg)

. Selling a share is treated the same as selling any other capital property. This will need to be reported in their annual income. However youll receive a 50 discount on.

Including a 10000 capital gain in income would cost 3700. However once the general 50 discount is deducted the taxpayer. If you sell a house in Australia add the capital gain to your tax return for that financial year.

Capital gains is treated as part of your income tax. A Capital gain or. Capital losses on personal use assets are ignored.

Capital gains tax CGT applies in Australia when you sell shares an investment property or other asset at a profit. If you earn 40000 325 tax bracket per. This means you cannot.

Complying SMSFs are entitled to a capital gains tax CGT. What is capital gains tax CGT. If an investor sells an investment for more than the cost to acquire it they have realised a capital gain.

List of CGT assets and exemptions Check if your assets are subject to CGT exempt or. The two CGT worksheets provided will help you keep track of your records and work out any capital gains or capital losses you need to include in your tax return. Capital Gains Tax Rates for Business in Australia Capital Gains for corporations which includes companies businesses etc are taxed at a fixed rate the fixed rate of Capital Gains tax being.

The amounts that are subject to tax vary but the resulting capital gain is included with your income and taxed at whatever marginal rate you. The capital gain is taxed in the year the asset is sold. It applies to property shares leases goodwill licences foreign currency.

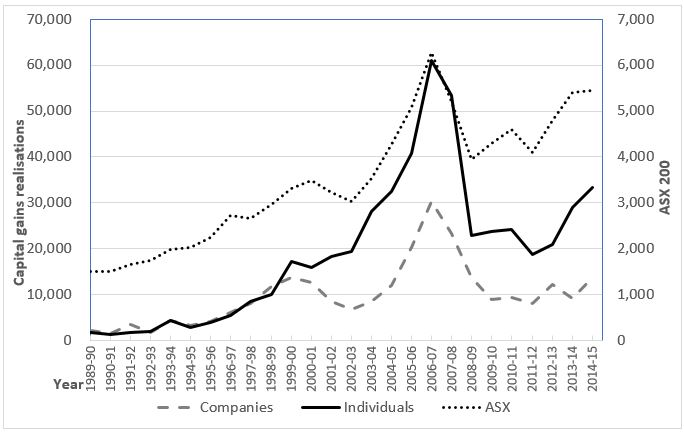

If you own the asset for longer than 12 months you will pay 50 of the capital gain. Australias CGT as originally enacted to commence in the 1985-86 fiscal year promoted tax system integrity by taxing capital gains at the same rate as the ordinary income of individuals. Of your net capital gain of 750000 you must pay 75 in capital gains tax which is 56250 You must then work out five-tenths of the capital gains tax which is 28125 You mustnt forget.

You essentially make a capital gain when the difference between the cost of. Property taxes in Australia are assessed on the value of the land rather than real estate or other improvements to land. Your SMSFs assessable income includes any net capital gains unless the asset is a segregated current pension asset.

Capital gains are taxed at the same rate as taxable income ie. How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets. The tax on the capital gain would be 37.

If you have a capital asset that you sell youll be left paying the full rate of capital gains tax if you sell it within 12 months of purchase. If you do not pay income tax in Australia the. Some strengths of the Australian tax system.

CGT doesnt apply to most personal property and items such. A capital gain on a personal use asset is subject to CGT if it cost you more than 10000 to acquire the asset.

Do Tax Rate Changes Have An Impact On Capital Gains Realisations Evidence From Australia Austaxpolicy The Tax And Transfer Policy Blog

7 Best Crypto Tax Calculators 2022 Accounting Software Guide

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

Claiming Losses Against Capital Gains Tax Contracts For Difference Com

Will Joe Biden S Proposed Taxes On Capital Make America An Outlier The Economist

Capital Gains Tax Changes Would Impact Millions Over The Next Decade Report

Capital Gains Tax Worksheet Excel Australia Capital Gains Tax Capital Gain Spreadsheet Template

Doing Business In Au丨features Of Our Tax System China Law Insight

Do I Pay Crypto Tax In Australia 2022

The Interface Between Capital Gains Tax And Estate Duty And The Double Tax Implications Thereof Semantic Scholar

Crypto Tax 101 What Is Cryptocurrency Capital Gains Tax Koinly

Capital Gains Tax Cgt Australia Explained With Examples Youtube

The Grief Of Greensill Distributing Capital Gains To Non Resident Beneficiaries Capital Gains Tax Australia

Savings And Investment Oecd Capital Gains Tax Retirement Accounts

No Death Duties In Australia But Look Out For Capital Gains Tax Lynn Brown Lawyers

The Capital Gains Tax Property 6 Year Rule 1 Simple Rule To Avoid Cgt Duo Tax Quantity Surveyors

Capital Gains Tax Cgt What To Know Before You Sell Your Investment Property Rent Blog